Countries around the world respect the United States. It has a world-class higher education system. It prepares talented graduates for impactful careers. America’s esteemed colleges and universities have top business schools. These schools train top financial analysts. They also train investment managers. They also train corporate budget directors, banking vice presidents, and similar finance professionals. The training specializes in specific areas. It grounds students in the details of money systems and capital flows. These things underpin today’s dynamic economy. These 10 universities are across vast Ivy League campuses. They are at specialized technology institutes and prestigious public research hubs. They offer premier programs to unlock lucrative opportunities in competitive finance.

University of Pennsylvania

The Ivy League University of Pennsylvania is historic. UPenn is the abbreviation. It established its eminent business school, Wharton, in 1881. It did so to help new industrial enterprises. Now, Wharton extends its mission empowering visionary financial leadership. Wharton has educated billionaire investment tycoons. It’s also educated Federal Reserve chairs who drive national monetary policies. It has educated legions of Fortune 500 financial executives. It has educated the founders of Wall Street private equity powerhouses. It has also educated founders of big banks like Bank of America. $2 billion donor gifts back Wharton’s finance education and alumni network. These gifts were transformational. They top almost every ranking.

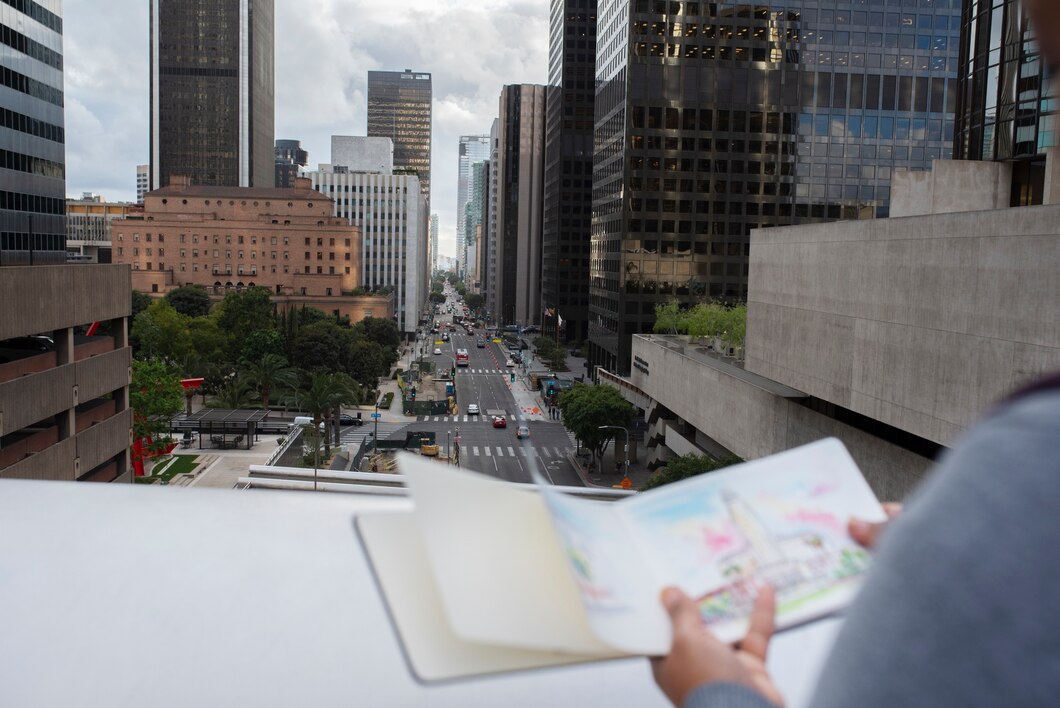

New York University

New York University’s Stern School is prestigious. It profits from its address in Greenwich Village. Wall Street and the growing Manhattan financial district entwine the area. The district houses global investment banks, stock exchanges, and monetary authorities. They craft policies with worldwide effects. Admission to Stern’s undergrad business programs is early and competitive. The same is true for the specialized Master of Science in Global Finance degrees. They are fast-tracks. They are at the symbolic heart of international finance. They help graduates land elusive financial jobs. Stern also enables great finance internships and networking. It welcomes industry icons as guests at its $100 million facility.

UC Berkeley

UC Berkeley’s Haas School of Business is near San Francisco. San Francisco is a hub of venture capitalism and West Coast wealth. The school trains finance leaders who marshal capital for technological disruption. Haas pioneers high-ranking Master of Financial Engineering and Ph.D. programs. It does this using math models. They nurture Silicon Valley finance. Over 9,000 Berkeley alumni shape global capital flows. They include Federal Reserve bank presidents. They also include billionaire enterprise CEOs, like Apple’s Tim Cook. Berkeley also guides ethical public policy. It balances market priorities, progress, and society.

University of Michigan

Ann Arbor has Midwest living costs. They are affordable. The school has 250,000 prominent alumni across financial citadels. The University of Michigan Ross School of Business offers top-notch education. It’s like what you’d get on the East Coast but much cheaper. Ross’s finance teaching fuses thought leadership with hands-on learning. It manages the school’s $100 million student-run investment fund. The fund outperforms benchmarks. This real-world asset experimentation yields Ross finance graduates coveted despite Midwest locale. Later, Ross alumni rise in finance across Chicago, New York, and California. They oversee trading, research, and mergers in busy finance hubs.

Massachusetts Institute of Technology

MIT, also known as MIT, is a leader in technology. It uses its world-leading Sloan School of Management to tackle complex finance frontiers. MIT pulsates with innovation. It explores cryptographic ledgers, AI predictive analytics, and computational tools. These tools elevate financial system efficiencies. MIT’s Kendall Square is an entrepreneurial launchpad. Sloan finances pioneering startups there. They’re creating cutting-edge financial apps. They use quantum computing, biometric blockchain, and robotic process automation. They’re also working on other new Fintech concepts. Investors worldwide mandate these.

Indiana University

Indiana University’s Kelley School of Business undergoes an appraisal. It excels at preparing versatile financial talent. Kelley’s produces exemplary graduates. The Capital Markets and Investment Banking Institute grooms them. Despite its Midwest location, the Institute attracts recruiters to its graduates. Kelley also propels prolific business startup activity for scaling finance functions. Seventy percent of Kelley finance undergraduates get jobs . They work with respected employers like J.P. Morgan, Disney, Amazon and Goldman Sachs. The rest start their own companies in Indiana’s emerging tech hubs.

The University of Texas

The McCombs School of Business is a powerhouse. It’s at The University of Texas – Austin. It fuels talented financial analysts. It’s in booming Austin’s entrepreneurial ecosystem and Texas capital markets. McCombs finance students manage $13 million. Diversified Longhorn Funds spread the money across. They experiment with hands-on security analysis and portfolio management. This training creates investors. Later, they direct asset management at the huge state Permanent School Fund. They also do so at the elite Principal Financial. They do so at the local VC trailblazer Silverton Partners. These investors capitalize on Austin’s networks of agile startups. McCombs supplies financial decision makers. They work for leading energy sector firms and big tech conglomerates. These businesses thrive in Texas.

University of Florida

Florida’s Warrington College of Business is prestigious. The University of Florida, a formidable institution, trains qualified financial professionals. They are in demand And, the school offers affordable, in-state tuition subsidies. Warrington prepares undergraduates across banking, corporate finance and investment roles. Meanwhile, Florida MBA candidates manage the Gator Student Investment Fund. They use tactics to beat the market. They do this to get finance jobs after graduation. They do this from Atlanta to Miami and beyond. Warrington further helps Florida graduates. They do this by using local ties with 139,000 alumni. They also use ties with local banks. They also use ties with wealth managers and real estate investors. These banks are rising.

Boston University

Massachusetts has technology, biomedical, and advanced manufacturing. They need billions in growth financing. Boston has a large finance ecosystem flowing trillions. Boston University’s esteemed Questrom School of Business grooms competent finance graduates. They secure satisfactory industry positions. Questrom has a four-course Financial Technology concentration. It also has a FinTech Club. They help students focused on modernizing financial systems with leading-edge software. This education breeds tech-savvy Questrom finance alumni. They lead financial automation for banks. The banks are State Street and Liberty Mutual Insurance. Also, Fidelity, American Tower, and General Electric are banks. These banks use over 25,000 people.

Fordham University

Fordham University’s Gabelli School of Business in New York City is selective. It prepares ethical, versatile financial managers. It does this through Jesuit values that mix compassion with commerce. Fordham allows undergraduates unique managing experience overseeing the university’s $25 million endowment. These duties are meaningful. They prepare Fordham graduates well for jobs in asset management and banking. This is at elite firms like Goldman Sachs, J.P. Morgan, Morgan Stanley, and American Express. Seasoned faculty and Fordham’s vast finance-focused alumni network propels more lifelong opportunities.

Check Also: Royal Academia: Exploring the Prestigious Universities in the United Kingdom

Conclusion

The top 10 finance universities are in different states of USA. One is in Boston. They excel at training graduates. They teach them to manage money, raise profits, boost efficiency, and fund progress. They do this for powerful global corporations, banks, or policy groups. Their business schools have a lot of history. They combine academic smarts, hands-on experiences, networking, tech tools, and ethics. They meet huge demand in finance. This demand is for top talent. This talent directs trillions of dollars. They direct them toward ventures driving growth, returns, and innovation.